Economic growth

- The property sector experienced a difficult Q3 of 2023 as share prices of listed property funds fell

- Numerous challenges faced, like loadshedding, high interest rates, rising operating costs (inclrates and taxes), poor municipal service delivery and low economic growth

- GDP growth is underperforming due to pressure on household spending, business investment & exports

- National Treasury is expecting economic growth of 0.9% in 2023 and 1.5% in 2024

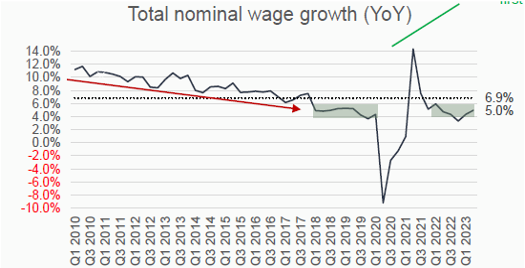

SA Inflation at 6,2% for Q2, SARB targeted average 5,3%.

Higher than expected due to:

- Rand volatility

- Global inflation elevated

- Fuel Price impact on inflation

- Impact of load-shedding on supply chains

- Geopolitical events

- Logistics challenges

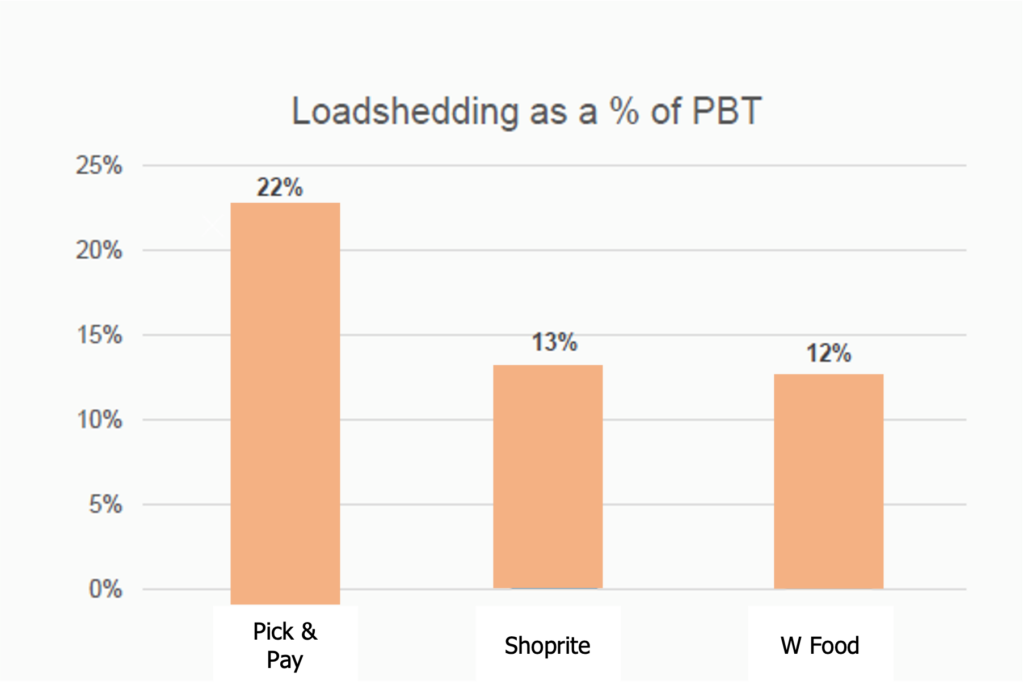

Loadshedding impact on the economy is negative

- Load-shedding has reached an average of Stage 4 in 2023

- Negatively affecting consumer confidence, retail spending, business investments, and international perceptions

- SARB estimates that load-shedding reduced economic growth by 1.4 % in 2022 and a further loss of 2% in 2023

- Businesses are seeing production downtime, increased supply chain costs, reduced operating hours, and increased security risks

Actions in response to the increased load-shedding by private households